Warren Buffett is often revered as one of the greatest investors of all time. With a net worth that has soared into the hundreds of billions, his investment acumen has made him a household name. But what if I told you that the title of Warren Buffett financial advisor is a bit of a misnomer? While many people seek financial advisors to navigate the complex world of investing, Buffett has famously thrived by relying on his own principles and insights. In this article, we’ll explore the secrets behind Warren Buffett’s investment success and what you can learn from his approach.

Understanding the Man Behind the Name

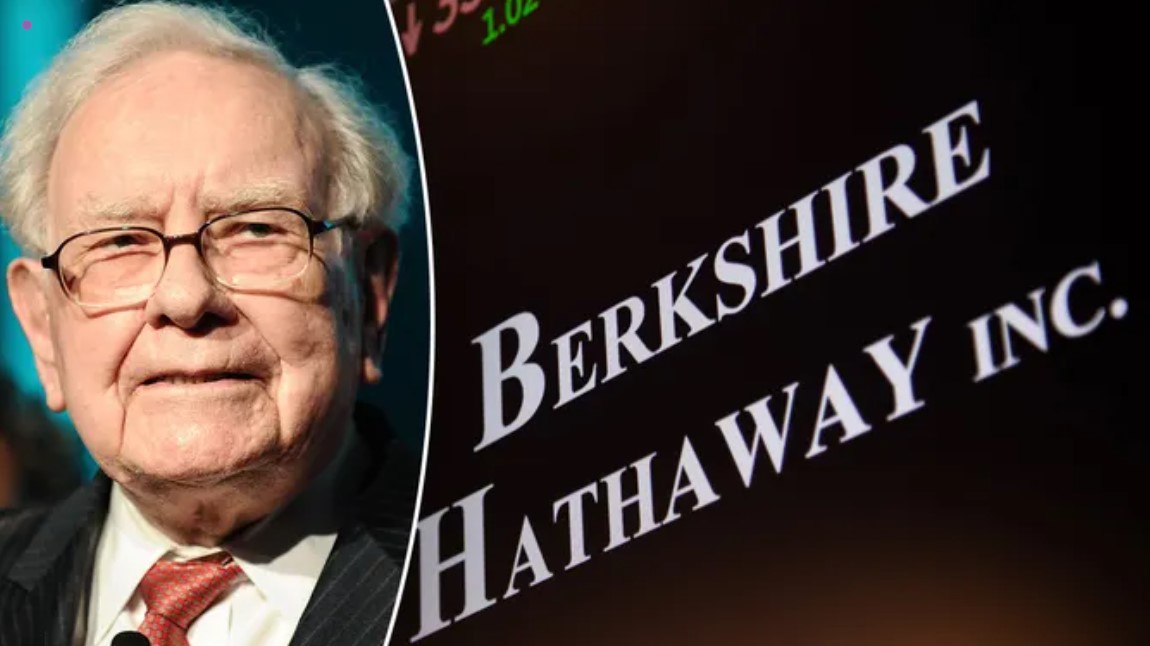

Before we dive into the Warren Buffett financial advisor secrets, it’s essential to understand who Warren Buffett is. Born in 1930 in Omaha, Nebraska, Buffett displayed an early aptitude for business and investing. He purchased his first stock at just 11 years old and has since dedicated his life to understanding the intricacies of the financial markets. His company, Berkshire Hathaway, is a testament to his investment philosophy, which focuses on long-term growth and value.

The Philosophy of Self-Education – Warren Buffett Financial Advisor

One of the core tenets of the Warren Buffett financial advisor approach is self-education. Buffett believes that the best investment you can make is in your own knowledge. He famously reads hundreds of pages each day, consuming everything from financial reports to biographies. By continually educating himself, Buffett can make informed decisions based on a deep understanding of the market and the companies he invests in.

For aspiring investors, this means prioritizing education. Consider reading investment classics such as Benjamin Graham’s The Intelligent Investor or Philip Fisher’s Common Stocks and Uncommon Profits. Understanding the fundamentals of investing is crucial for anyone looking to succeed without a traditional financial advisor.

Long-Term Thinking is Key

Another critical aspect of the Warren Buffett financial advisor strategy is long-term thinking. Buffett has repeatedly stated that his favorite holding period is “forever.” This philosophy encourages investors to look beyond short-term market fluctuations and focus on the long-term potential of their investments.

By adopting a long-term perspective, investors can ride out market volatility and take advantage of the compounding effect on their investments. This means choosing quality companies with strong fundamentals and holding onto them for extended periods, rather than chasing after short-term gains.

The Importance of Intrinsic Value

A fundamental principle in the Warren Buffett financial advisor toolkit is the concept of intrinsic value. Buffett emphasizes that investors should not only consider a stock’s current price but also its true worth. This involves evaluating a company’s fundamentals, including its earnings, growth potential, and competitive advantages.

To apply this principle, conduct thorough research on companies before investing. Look at their financial statements, analyze their business models, and assess their market position. By understanding intrinsic value, you can make more informed investment decisions that align with Buffett’s strategies.

Discipline and Emotional Control – Warren Buffett Financial Advisor

Investing can be an emotional rollercoaster, especially during periods of market volatility. However, one of the key Warren Buffett financial advisor secrets is maintaining discipline and emotional control. Buffett has a remarkable ability to remain calm when others panic, allowing him to make rational decisions in uncertain times.

To cultivate this discipline, it’s essential to have a well-defined investment strategy. Set clear goals, establish your risk tolerance, and stick to your plan even when the market becomes turbulent. This approach can prevent emotional decision-making that often leads to poor investment outcomes.

Focus on Quality Companies

Buffett is known for his preference for investing in high-quality companies with strong competitive advantages, often referred to as “economic moats.” This term describes a company’s ability to maintain its market position against competitors. A strong moat can come from brand loyalty, unique products, or cost advantages.

When searching for investment opportunities, prioritize companies with these qualities. Conduct thorough research to identify businesses that possess a sustainable competitive edge. This strategy aligns with the Warren Buffett financial advisor philosophy and can lead to more profitable investments.

The Power of Patience – Warren Buffett Financial Advisor

Patience is a virtue in investing, and it’s a principle that Warren Buffett embodies. The Warren Buffett financial advisor secrets highlight the importance of waiting for the right opportunities to present themselves. Buffett often advises investors to be greedy when others are fearful and fearful when others are greedy. This counterintuitive approach can lead to significant investment gains when executed correctly.

To develop patience as an investor, practice mindfulness and avoid getting caught up in daily market noise. Stay focused on your long-term goals, and don’t let short-term market movements dictate your investment decisions.

Diversification vs. Concentration

Many financial advisors advocate for diversification as a means of reducing risk. However, Buffett takes a different approach. He believes in concentrating investments in a few well-researched companies rather than spreading investments too thin. This philosophy is part of the Warren Buffett financial advisor secrets that can lead to higher returns if executed correctly.

While diversification can help mitigate risk, it can also dilute potential returns. Buffett argues that investors should focus on their best ideas and invest heavily in those. This approach requires thorough research and confidence in your investment choices, but it can lead to exceptional results.

Continuous Learning and Adaptation

In the ever-evolving landscape of investing, the Warren Buffett financial advisor secrets also emphasize the importance of continuous learning and adaptation. Markets change, and new trends emerge, making it crucial for investors to stay informed. Buffett himself adapts his strategies based on changing market conditions while staying true to his core principles.

Investors should regularly review their portfolios, stay updated on industry trends, and be open to adjusting their strategies as needed. This flexibility can be the difference between success and failure in the investment world.

Networking and Mentorship – Warren Buffett Financial Advisor

While Warren Buffett doesn’t rely on a financial advisor, he values the importance of building a network and seeking mentorship. Buffett has often credited his success to the influence of mentors, such as Benjamin Graham and Charlie Munger. Networking with like-minded individuals can provide valuable insights and foster growth.

Consider joining investment clubs or online forums where you can share ideas and learn from others. Finding a mentor in the investing space can also accelerate your learning process and help you navigate the complexities of the financial markets.

Conclusion

In conclusion, the Warren Buffett financial advisor secrets reveal a path to investment success that relies on self-education, long-term thinking, and a disciplined approach. By understanding intrinsic value, focusing on quality companies, and maintaining emotional control, investors can implement Buffett’s strategies effectively. Remember, while many seek the advice of a financial advisor, the true power lies in your ability to learn, adapt, and trust your instincts. Embrace these principles, and you may find yourself on the path to financial success just like Warren Buffett.

Author: Albert Stellar

Follow us on Youtube: The Investors Community