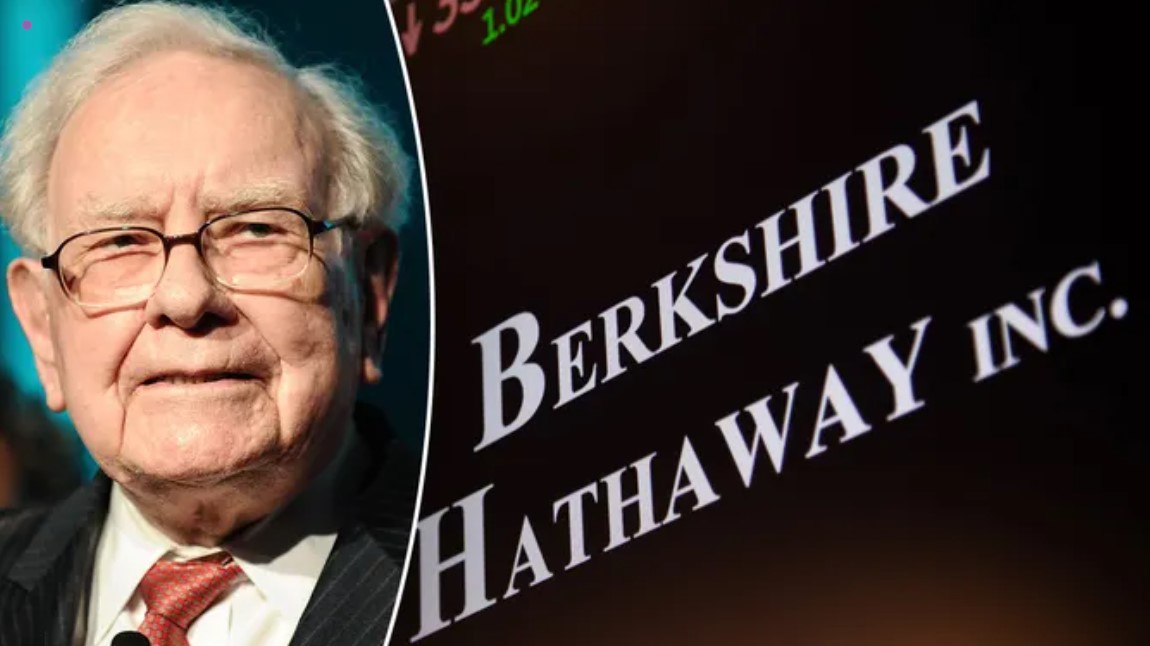

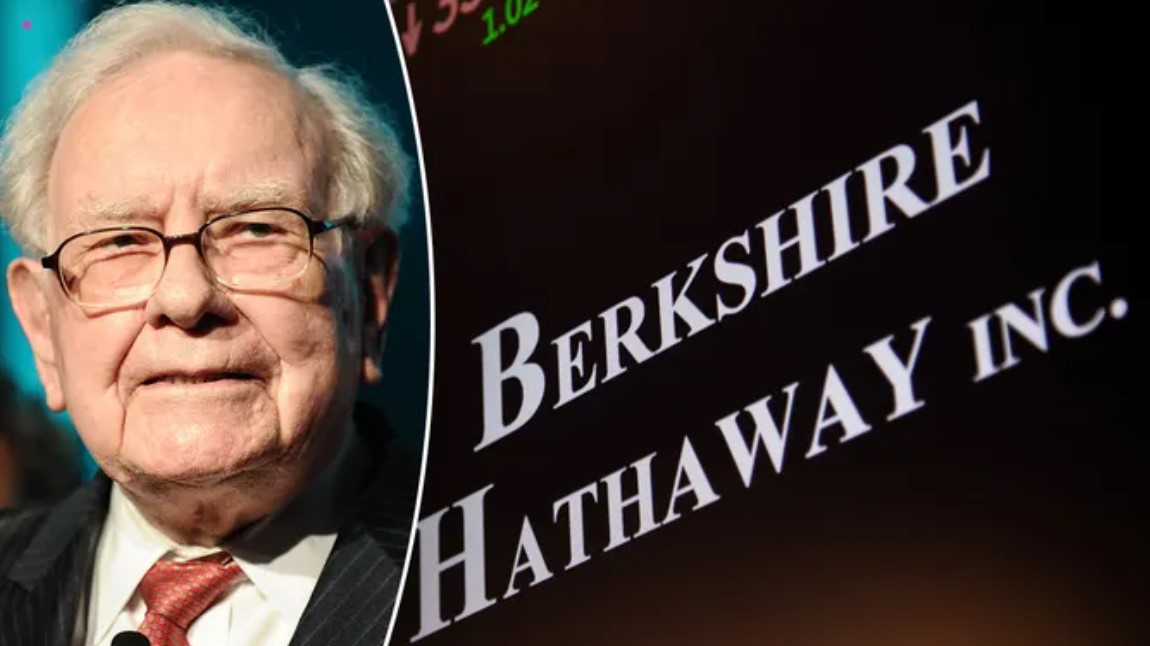

The Warren Buffett insurance company is a significant aspect of Buffett’s investment empire, playing a crucial role in his overall investment philosophy. Few names resonate as strongly in the world of investing as Warren Buffett, often referred to as the “Oracle of Omaha.”

His investment strategies and principles have influenced countless investors. This article delves into why investors trust the Warren Buffett insurance company for growth, exploring its unique business model, investment strategies, and the underlying principles that drive its success.

Understanding the Warren Buffett Insurance Company

Warren Buffett’s approach to investing has always been rooted in understanding the businesses he invests in. The Warren Buffett insurance company is no exception. Primarily through Berkshire Hathaway, Buffett has built a diverse portfolio of insurance companies, including Geico, General Re, and others. These companies are not just sources of revenue; they serve as fundamental components of Buffett’s investment strategy.

The Business Model of the Warren Buffett Insurance Company

The business model of the Warren Buffett insurance company is centered around the concept of underwriting and investment income. Insurance companies collect premiums from policyholders, and in return, they provide financial protection against various risks. This premium income allows the company to invest in other ventures, generating additional revenue streams.

Buffett’s insurance companies are particularly adept at using this model to their advantage. By underwriting policies in various sectors, the Warren Buffett insurance company can diversify its income and mitigate risks. This diversification is a key reason why investors trust the Warren Buffett insurance company for growth. The stability provided by multiple revenue streams allows Buffett to reinvest profits into other high-growth opportunities.

The Importance of Underwriting Discipline

One of the hallmarks of the Warren Buffett insurance company is its underwriting discipline. Buffett has always emphasized the importance of carefully selecting the risks the company is willing to underwrite. This meticulous approach to underwriting ensures that the insurance company remains profitable over the long term.

Investors are drawn to the Warren Buffett insurance company because of its track record of profitability. Buffett’s philosophy revolves around only accepting risks that the company can manage effectively. This discipline helps prevent the catastrophic losses that can plague less careful insurers. By maintaining a strong underwriting performance, the Warren Buffett insurance company builds trust with its investors, assuring them of sustained growth and stability.

Investment Strategy: A Unique Perspective – Warren Buffett Insurance Company

The investment strategy of the Warren Buffett insurance company sets it apart from other insurers. While many insurance companies focus solely on their underwriting operations, Buffett’s approach is much broader. He uses the capital generated from the insurance business to invest in a wide array of companies across different industries.

Buffett’s investment philosophy emphasizes value investing. He seeks out undervalued companies with strong fundamentals and growth potential. By purchasing these companies, the Warren Buffett insurance company not only diversifies its portfolio but also leverages the growth of these investments to enhance overall returns. This strategy allows investors to benefit from both the insurance operations and the performance of the underlying investments, reinforcing their trust in the Warren Buffett insurance company for growth.

The Role of Cash Flow in Growth

Cash flow is a critical component of the Warren Buffett insurance company’s success. Insurance companies often operate with a significant amount of cash flow, generated from premium collections and investment income. This cash flow allows Buffett to take advantage of investment opportunities as they arise, ensuring that the company can quickly adapt to changing market conditions.

The Warren Buffett insurance company’s ability to maintain strong cash flow is a testament to its effective business model. This consistent cash flow not only provides stability but also enables the company to invest in new ventures and expand its existing operations. Investors recognize the importance of cash flow in supporting long-term growth, making the Warren Buffett insurance company a trusted choice for those seeking reliable investment opportunities.

Risk Management Practices – Warren Buffett Insurance Company

Effective risk management is another reason why investors trust the Warren Buffett insurance company for growth. Buffett has long understood that the insurance industry is inherently risky. However, he has developed robust risk management practices that help mitigate potential losses.

The Warren Buffett insurance company employs a comprehensive approach to risk management, analyzing various factors that could impact its portfolio. By diversifying its investments and carefully monitoring market trends, the company can adjust its strategies as needed to protect against adverse conditions. This proactive approach to risk management instills confidence in investors, reinforcing their trust in the Warren Buffett insurance company for growth.

Historical Performance and Track Record

The historical performance of the Warren Buffett insurance company speaks volumes about its reliability as an investment vehicle. Over the years, Berkshire Hathaway has consistently delivered strong returns to its shareholders. Buffett’s ability to navigate through economic downturns and market volatility has earned him a reputation as one of the most successful investors in history.

Investors are drawn to the Warren Buffett insurance company not only for its current performance but also for its long-term track record. The company has weathered numerous financial storms, emerging stronger each time. This resilience is a key factor that reassures investors about the potential for future growth.

The Power of Brand Recognition – Warren Buffett Insurance Company

Warren Buffett’s name alone carries significant weight in the investment community. The Warren Buffett insurance company benefits from this brand recognition, which enhances investor trust. Buffett’s reputation for honesty, integrity, and sound investment principles attracts investors looking for reliable opportunities.

This brand recognition extends beyond just individual investors; institutional investors also take notice of the Warren Buffett insurance company. The confidence that comes with Buffett’s name adds an additional layer of credibility, making it an attractive option for those looking to diversify their portfolios.

Commitment to Shareholder Value

At the core of Buffett’s investment philosophy is a commitment to shareholder value. The Warren Buffett insurance company embodies this commitment by prioritizing the interests of its shareholders. Buffett has consistently demonstrated that he views his role as a steward of capital, aiming to maximize returns for those who invest in his companies.

This focus on shareholder value is reflected in the company’s performance metrics and distribution policies. By maintaining a strong balance sheet and generating consistent returns, the Warren Buffett insurance company reassures investors that their interests are aligned with those of management. This alignment fosters trust and encourages long-term investment.

Strategic Acquisitions and Growth Opportunities

The Warren Buffett insurance company is known for its strategic acquisitions, which play a vital role in its growth strategy. Buffett has a keen eye for identifying undervalued companies that can complement his existing operations. By acquiring these businesses, he not only expands the company’s portfolio but also enhances its overall market position.

These strategic acquisitions are often driven by a desire to leverage synergies and create value for shareholders. Investors trust the Warren Buffett insurance company because they know that Buffett’s decisions are backed by thorough analysis and a deep understanding of the industries in which he operates.

The Importance of Long-Term Thinking

Warren Buffett’s investment philosophy is grounded in long-term thinking. The Warren Buffett insurance company exemplifies this approach by focusing on sustainable growth rather than short-term gains. Buffett encourages investors to adopt a similar mindset, emphasizing the value of patience and discipline in achieving financial success.

This long-term perspective is particularly appealing to investors looking for stability and consistency. The Warren Buffett insurance company’s commitment to building lasting relationships with its policyholders and clients further reinforces this approach, allowing the company to thrive in the competitive insurance landscape.

Conclusion

Investors trust the Warren Buffett insurance company for growth due to its unique business model, strong underwriting discipline, and commitment to shareholder value. With a proven track record of performance and a focus on long-term thinking, Buffett has built an investment vehicle that not only generates returns but also instills confidence in its stakeholders.

The combination of effective risk management practices, strategic acquisitions, and the power of brand recognition further solidifies the Warren Buffett insurance company’s position as a trusted choice for investors. As the investment landscape continues to evolve, the principles that guide the Warren Buffett insurance company remain steadfast, ensuring its continued success and growth for years to come.

Author: Albert Stellar

Follow us on Youtube: The Investors Community