Understanding the Berkshire Hathaway Model

To identify companies like Berkshire Hathaway, it’s essential to understand what makes Berkshire unique. At its core, Berkshire Hathaway operates as a holding company, investing in other businesses across various sectors. This strategy allows for diversification, which helps mitigate risks while maximizing potential returns. The company’s investment philosophy, centered around value investing, is key to its long-term success.

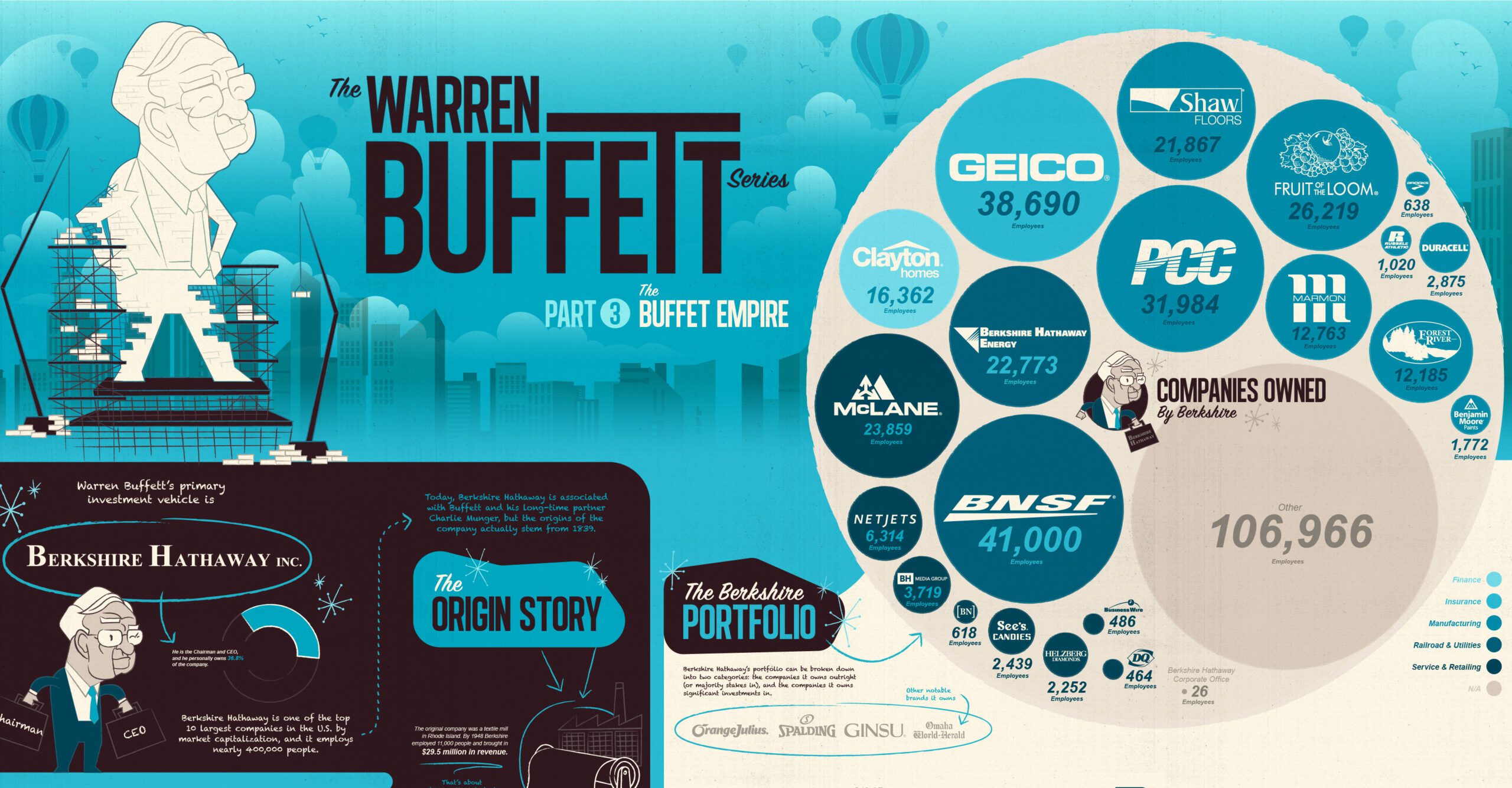

Warren Buffett emphasizes investing in businesses with strong fundamentals, capable management, and a competitive advantage in their respective markets. This approach has been pivotal in creating a portfolio that includes iconic brands like Coca-Cola, Geico, and Apple.

The Power of Diversification

Diversification is a significant reason for the resilience and success of companies like Berkshire Hathaway. By spreading investments across various industries, these companies can cushion against market volatility. If one sector faces downturns, another might thrive, balancing the overall performance of the portfolio.

Berkshire Hathaway’s diverse interests include insurance, utilities, manufacturing, retail, and more. This variety enables the company to capture opportunities in different markets while minimizing risks associated with reliance on a single industry. Other companies that emulate this strategy often build a diversified portfolio, providing similar advantages to their investors.

Identifying Companies Like Berkshire Hathaway

When looking for companies like Berkshire Hathaway, several characteristics emerge as common threads:

- Strong Management Teams: Successful companies are often led by visionary leaders who prioritize long-term growth over short-term gains.

- Value Investing Philosophy: Like Buffett, these companies seek undervalued businesses with strong fundamentals, ensuring potential for growth.

- Diversified Portfolios: Companies similar to Berkshire often invest across multiple sectors, reducing risk and increasing stability.

- Focus on Cash Flow: Strong cash flow allows for reinvestment and the ability to weather economic downturns.

- Commitment to Shareholder Value: Successful companies prioritize their shareholders’ interests, often returning value through dividends and share buybacks.

With these traits in mind, let’s explore some companies that embody these principles.

1. Markel Corporation

Markel Corporation is often referred to as a mini-Berkshire Hathaway. This company operates primarily in the insurance sector but has diversified its operations into other industries, such as investments and reinsurance. Like Berkshire, Markel follows a value investing philosophy and focuses on acquiring businesses that align with its long-term strategy.

Markel’s management is known for its disciplined approach to underwriting, ensuring profitability in its insurance operations. The company also invests its surplus cash in various businesses, creating a diversified portfolio that mirrors the Berkshire model. Investors appreciate Markel’s consistent performance and strategic growth initiatives, making it a prime example of companies like Berkshire Hathaway.

2. Fairfax Financial Holdings

Fairfax Financial Holdings is another company that operates similarly to Berkshire Hathaway. Based in Canada, Fairfax focuses on property and casualty insurance but has expanded into other sectors through strategic acquisitions. The company’s founder, Prem Watsa, is often dubbed the “Canadian Warren Buffett” for his value-oriented investment approach.

Fairfax’s success is rooted in its disciplined underwriting practices and a keen ability to identify undervalued opportunities. The company invests in a variety of businesses and has built a robust portfolio that contributes to its overall profitability. Fairfax exemplifies how companies like Berkshire Hathaway can thrive in the insurance industry while pursuing diverse investment opportunities.

3. Leucadia National Corporation

Leucadia National Corporation, now known as Jefferies Financial Group, has built a reputation as a diversified holding company. With investments in various sectors, including finance, manufacturing, and real estate, Leucadia operates on principles akin to those of Berkshire Hathaway.

Under the leadership of CEO Rich Handler, Jefferies has successfully navigated market changes and expanded its operations. The company’s focus on value creation through long-term investments aligns with the strategies of companies like Berkshire Hathaway. This commitment to growth and diversification has positioned Jefferies as a prominent player in the financial services industry.

4. 3G Capital

3G Capital is a global investment firm that specializes in acquiring and operating food and beverage companies. Founded by Brazilian investors Jorge Paulo Lemann, Marcel Telles, and Beto Sicupira, 3G is known for its aggressive investment strategies and focus on operational efficiency. The firm’s approach is similar to Berkshire Hathaway’s in that it seeks to acquire undervalued companies with strong potential for improvement.

3G Capital’s portfolio includes well-known brands such as Anheuser-Busch InBev and Restaurant Brands International, which owns Tim Hortons and Popeyes. By employing a rigorous cost-cutting strategy and operational improvements, 3G demonstrates how companies like Berkshire Hathaway can achieve significant growth in competitive industries.

5. Constellation Brands

Constellation Brands is a leading beverage alcohol company that has gained attention for its aggressive growth strategy and diverse portfolio. The company produces a wide range of beer, wine, and spirits, with well-known brands like Corona and Modelo.

Constellation has adopted a strategy similar to Berkshire Hathaway by making significant acquisitions to expand its portfolio. The company focuses on brands that have a competitive edge and growth potential, ensuring long-term profitability. Investors trust Constellation for its ability to adapt to changing consumer preferences, reflecting the attributes of companies like Berkshire Hathaway.

The Role of Strong Leadership

One common thread among companies like Berkshire Hathaway is the presence of strong leadership. The management teams of these companies often prioritize long-term vision, instilling confidence in investors. For instance, Warren Buffett’s leadership style is characterized by transparency, integrity, and a commitment to ethical practices.

Effective leaders understand the importance of nurturing a corporate culture that aligns with the company’s values. This culture fosters innovation, encourages collaboration, and motivates employees to contribute to the organization’s success. Strong leadership not only attracts investors but also creates a solid foundation for sustainable growth.

Learning from Mistakes

Another critical aspect of successful companies is their ability to learn from mistakes. Like Berkshire Hathaway, companies such as Markel and Fairfax have experienced challenges but have used those experiences to refine their strategies. Admitting failures and adapting to new circumstances is essential for long-term success.

For instance, Fairfax Financial experienced significant losses during the 2008 financial crisis. However, instead of shying away from risky investments, the management team adapted its approach, focusing on improving risk management practices. This resilience and willingness to learn from setbacks are vital traits shared by companies like Berkshire Hathaway.

The Importance of a Long-Term Focus

One of the primary reasons investors flock to companies like Berkshire Hathaway is their unwavering commitment to long-term success. In an era where short-term gains often take precedence, companies that prioritize sustainable growth stand out.

Warren Buffett famously advises investors to think of their investments as owning a piece of a business rather than merely buying stocks. This mindset is prevalent among successful companies, encouraging stakeholders to remain patient and focus on building value over time.

Investors should seek out companies that demonstrate a long-term focus, as they are more likely to weather market fluctuations and emerge stronger. Companies like Markel and Constellation Brands exemplify this approach, consistently delivering value to their shareholders through strategic decision-making.

Building Strong Brands

A key driver of success for companies like Berkshire Hathaway is the ability to build and maintain strong brands. Brand equity plays a crucial role in attracting customers and generating loyalty. Berkshire Hathaway’s portfolio includes some of the world’s most recognizable brands, contributing to its overall success.

Companies that prioritize brand building often invest in marketing, quality control, and customer service to create a positive reputation. For instance, Constellation Brands has developed a strong presence in the beverage industry by focusing on quality and innovation. This commitment to brand excellence not only attracts consumers but also increases investor confidence.

Adapting to Market Trends

In a rapidly changing business landscape, the ability to adapt to market trends is paramount. Companies like Berkshire Hathaway thrive by staying ahead of the curve and anticipating consumer demands. This adaptability is a significant factor in their continued success.

For example, as consumer preferences shift towards health-conscious products, many companies are diversifying their offerings to cater to this trend. Constellation Brands has expanded its portfolio to include low-calorie and healthier beverage options, ensuring they remain relevant in a competitive market.

Companies like Berkshire Hathaway embrace innovation and adaptability, allowing them to capitalize on emerging trends and maintain a competitive edge. By staying attuned to market shifts, these companies can create products and services that resonate with consumers, leading to sustained growth.

Conclusion

Investors looking for opportunities beyond Berkshire Hathaway can find inspiration in companies like Berkshire Hathaway. By embracing diversification, strong leadership, a long-term focus, and adaptability, these companies have carved out successful paths in various industries.

Understanding the principles that drive success in these organizations can guide investors in making informed decisions. Whether through strategic acquisitions, disciplined underwriting, or brand building, the secrets to success are evident in the operations of these thriving companies.

As investors navigate the complex world of finance, they should consider the lessons learned from companies like Berkshire Hathaway and apply these insights to their investment strategies. The potential for growth and profitability is within reach for those willing to embrace the principles that have guided these successful firms.

Author: Albert Stellar

Follow us on Youtube: The Investors Community