Nikola Stock Analysis – Imagine investing $1000 in Nikola in 2018. What would it be worth in March 2024?

In this hypothetical scenario, your $1000 investment would now be a mere $68. That’s a staggering 93% decrease from the initial investment.

Now, let’s consider another scenario. Say you invested the same $1000 in mid-2020. Fast forward to today, and you’d witness a shocking hundredfold decrease.

What caused this dramatic turn of events? Nikola’s financial situation holds the answer.

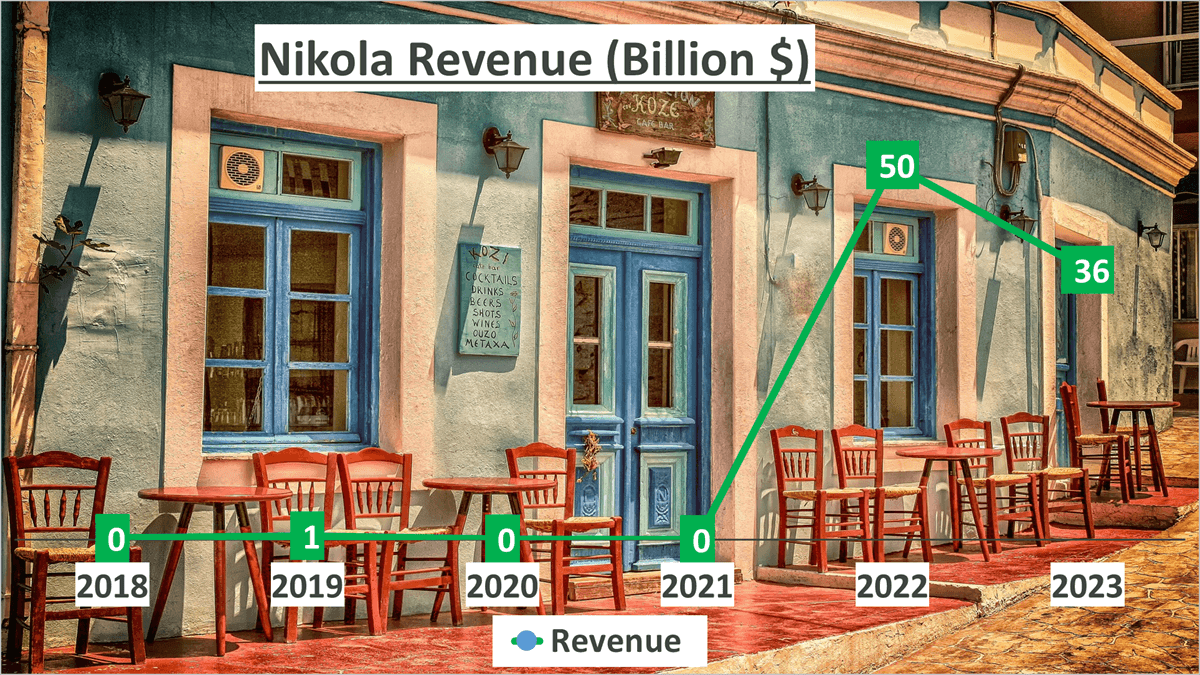

In 2020, Nikola’s stock value peaked, increasing sevenfold from 2018. However, the company had no revenue at the time. This surge was solely driven by investor expectations, fueled by misleading statements from Nikola’s chairman regarding their electric truck products.

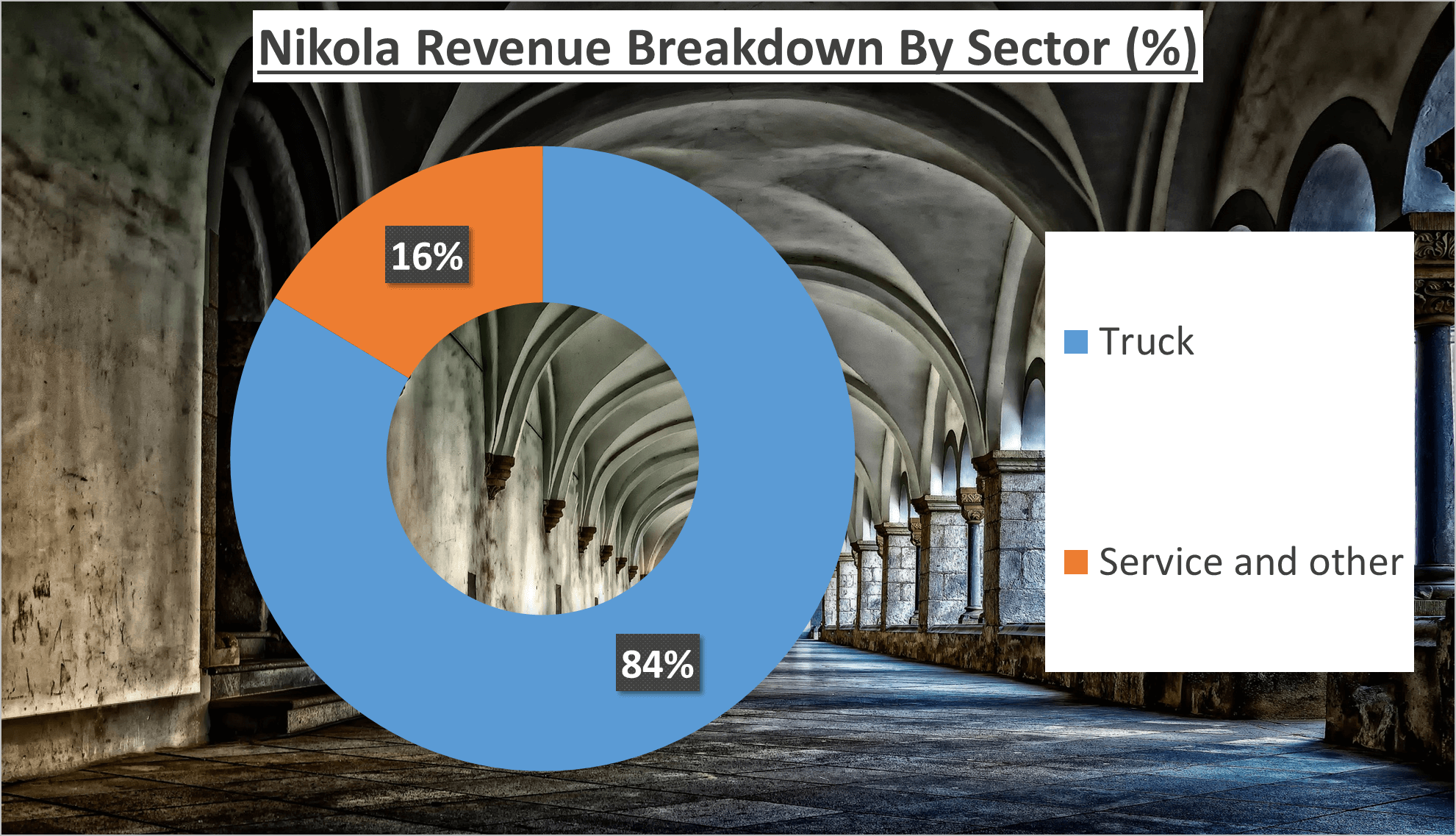

Moving forward to 2023, Nikola’s revenue dropped to $36 million, a significant decline from $50 million the previous year. The revenue breakdown for that year was 84% from trucks and 16% from services and other sources.

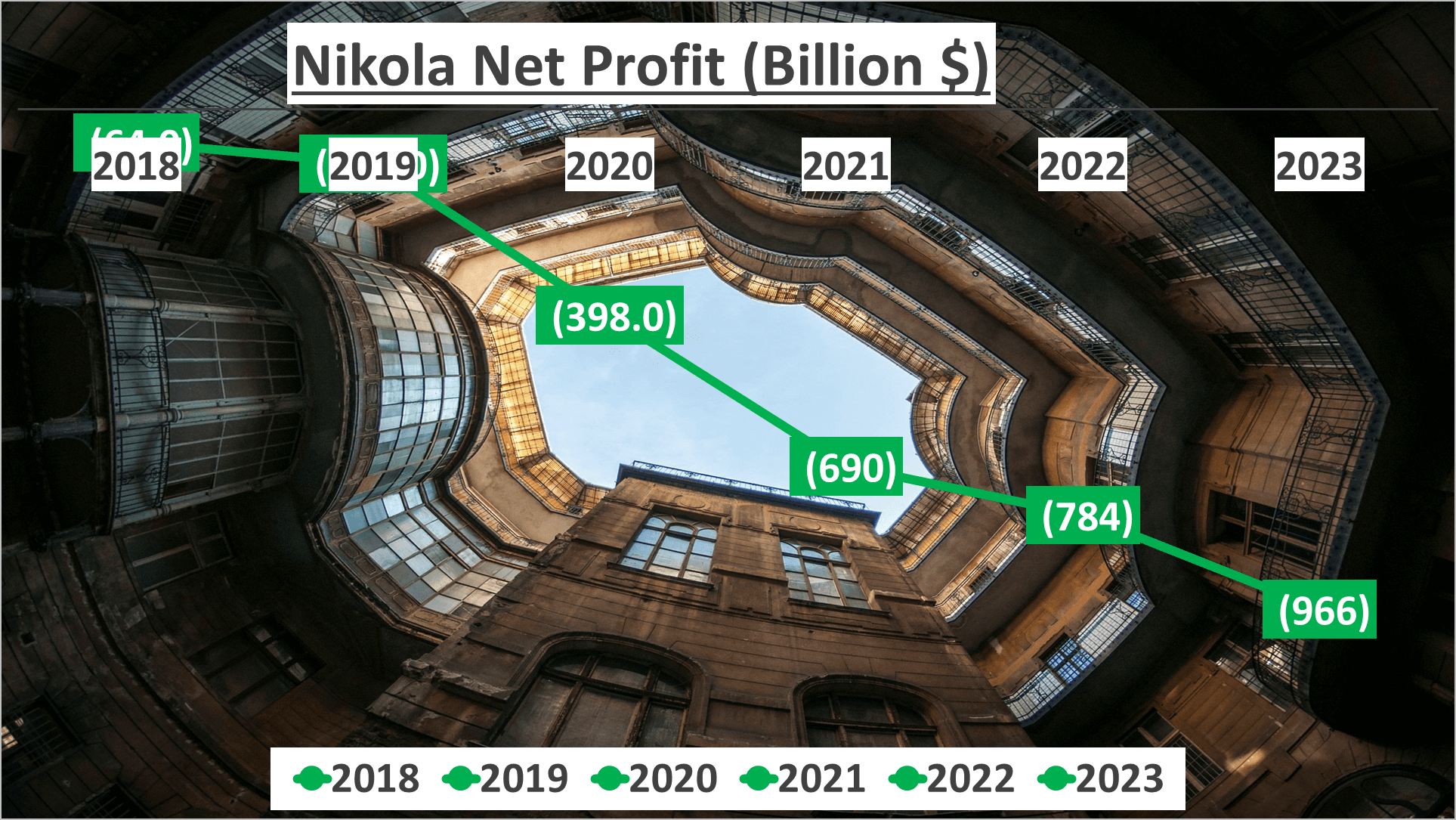

Despite this, the company’s net profit for 2023 was a staggering -$966 million. This loss has consistently grown over the years, starting at -$64 million in 2018 and increasing annually, culminating in the significant loss in 2023.

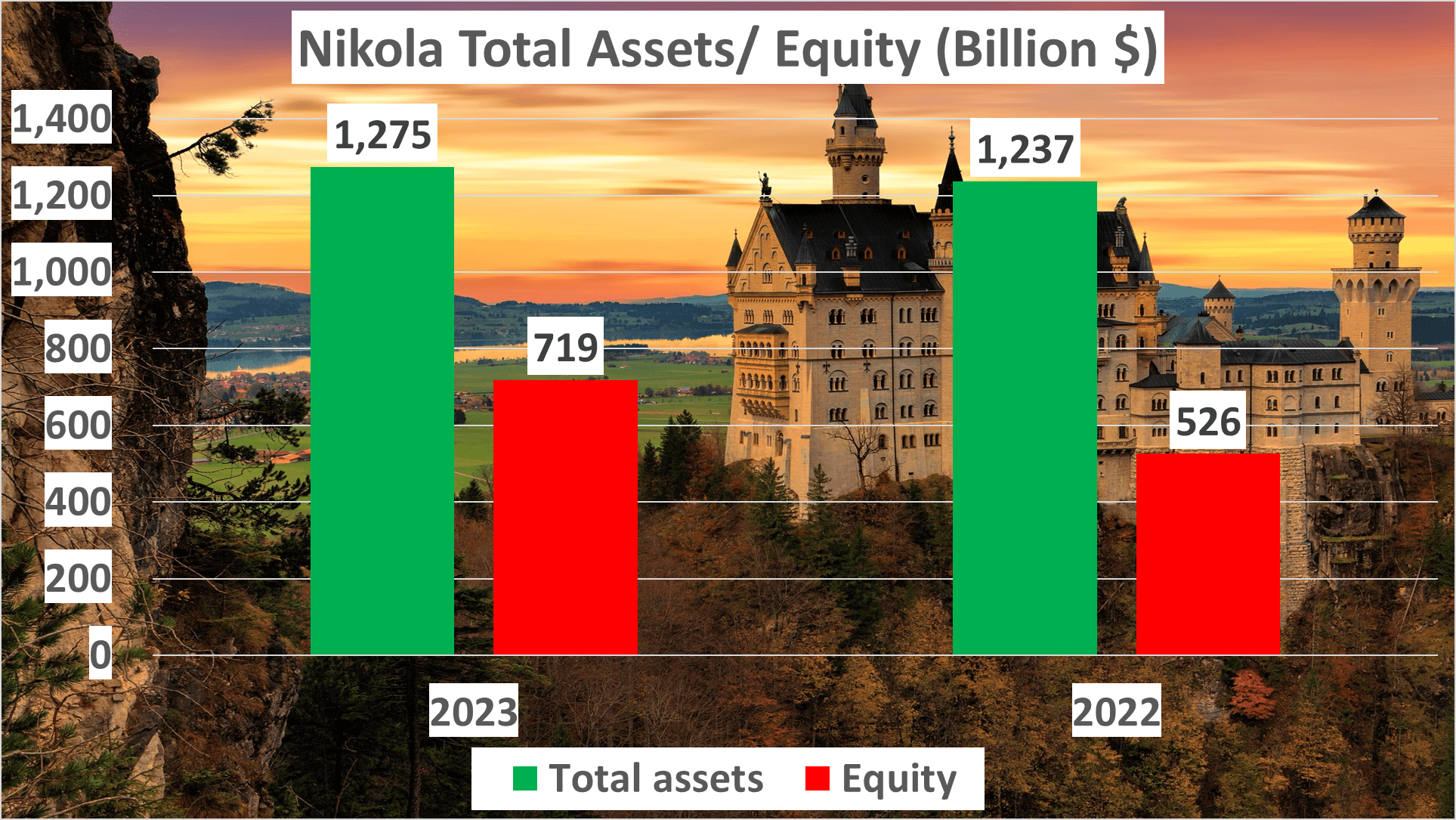

Total assets for 2023 stood at $1275 million, slightly higher than the previous year. Net assets for the same year were $719 million, compared to $526 million in 2022.

These figures offer insight into Nikola’s financial health. However, a deeper dive into the company’s financials is necessary to fully comprehend its situation.

Nikola’s Revenue Breakdown – Nikola Stock Analysis

Let’s delve into Nikola’s revenue. In 2023, Nikola’s revenue amounted to $36M.

Interestingly, this is a decrease from the $50M earned in the previous year, 2022.

Now, let’s rewind to mid-2020, when Nikola’s stock peaked, soaring to heights seven times higher than in 2018.

However, during this period, Nikola hadn’t generated any revenue. Not a single dollar.

This meteoric rise was fueled by investors’ expectations, based on the chairman’s statements about Nikola’s electric trucks.

But these claims proved to be inaccurate. Now, let’s explore how Nikola’s revenue was structured in 2023.

84% of it came from truck sales, with the remaining 16% from services and other sources.

Despite revenue diversification, Nikola’s financial health remained unstable.

The company’s inability to turn a profit, along with declining revenue, raises concerns about its financial stability.

Clearly, Nikola’s revenue has been on a downward trend.

Nikola’s Financial Health – Nikola Stock Analysis

When analyzing Nikola’s financial health, it’s essential to look beyond revenue and delve into other key indicators. Let’s explore further.

In 2023, Nikola reported a staggering net loss of -$966M. This loss has been consistently increasing over the years, starting at -$64M in 2018 and escalating annually.

Moving on to assets, Nikola’s total assets rose to $1.275B in 2023, slightly up from $1.237B the previous year. Net assets also saw a significant increase, reaching $719M compared to $526M in 2022.

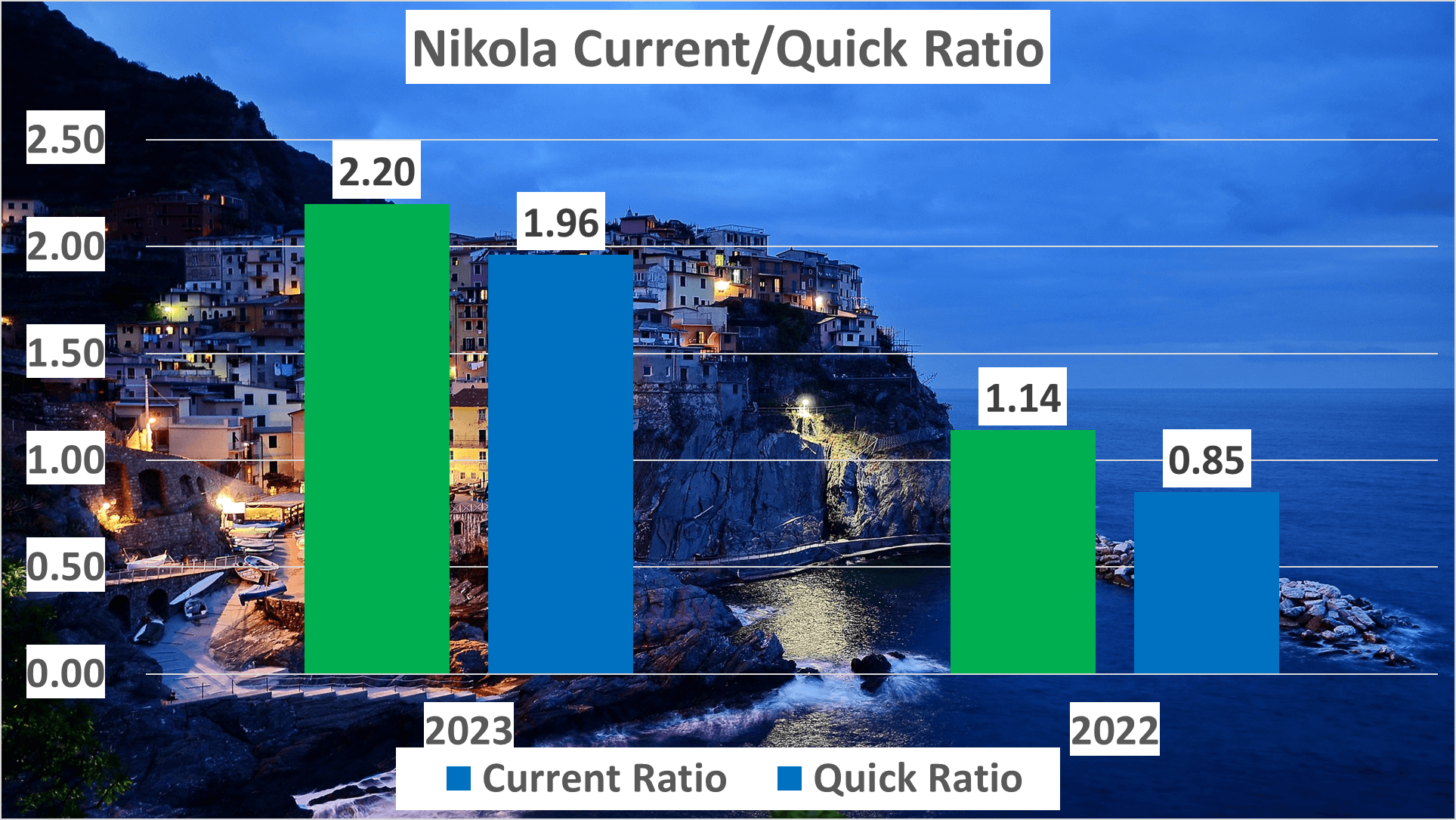

Regarding liquidity, Nikola’s Current Ratio improved to 2.2 in 2023, up from 1.14 in 2022, indicating a better ability to cover short-term liabilities with short-term assets. The Quick Ratio also increased from 0.85 in 2022 to 1.96 in 2023.

Despite these slight liquidity and asset improvements, Nikola’s mounting losses paint a concerning picture. The company has been facing significant financial struggles, evident from its increasing net loss over the years.

These numbers highlight Nikola’s financial challenges. While there have been modest improvements in asset and liquidity ratios, the company’s increasing losses overshadow them.

The question remains: Can Nikola overcome these financial challenges, or will they prove insurmountable? Only time will tell.

Cash Flow and Efficiency Analysis – Nikola Stock Analysis

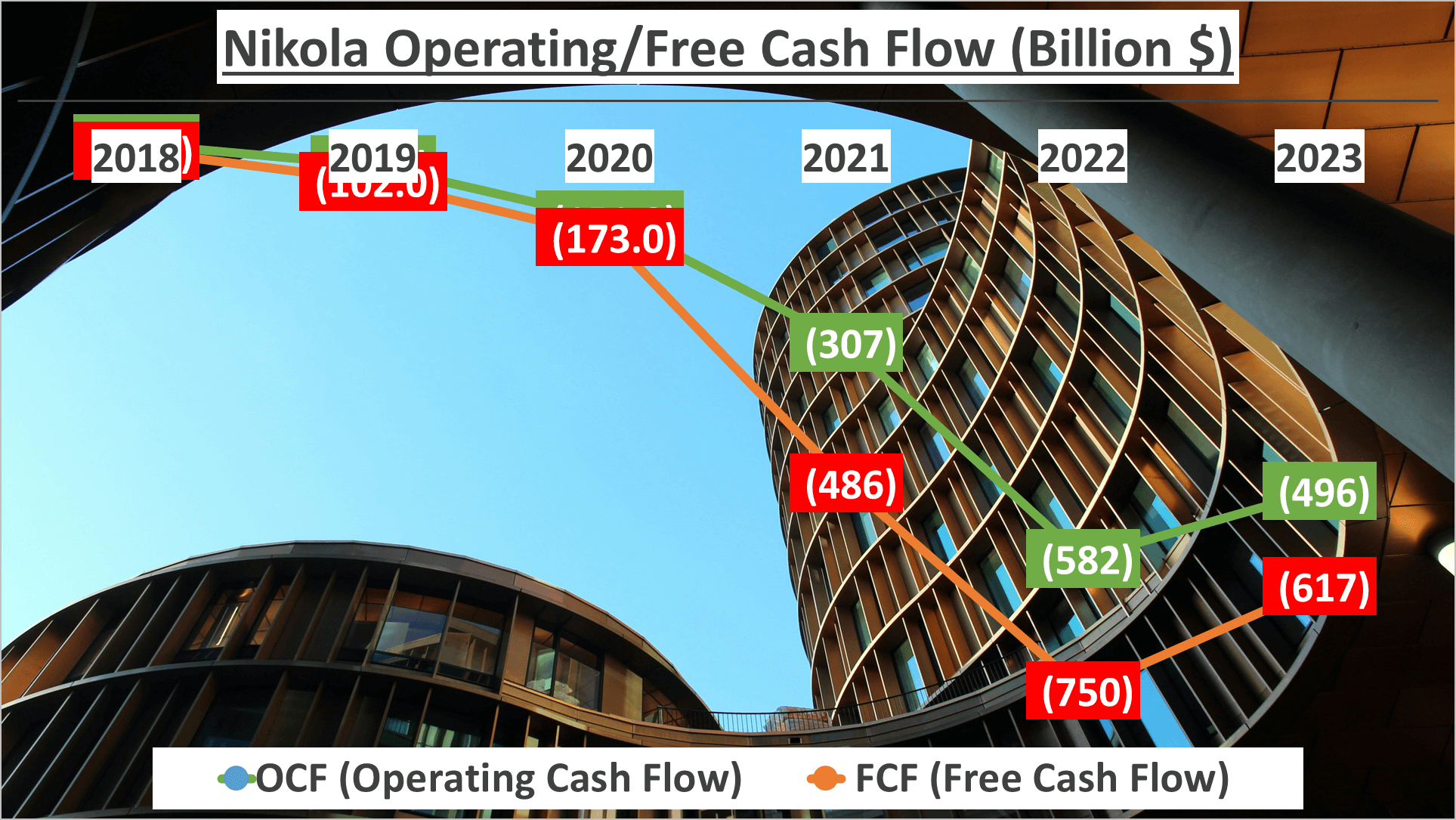

Cash flow and efficiency play pivotal roles in evaluating a company’s financial health. Let’s delve deeper into Nikola’s cash flow and efficiency in 2023.

Starting with cash flow, Nikola’s Operating Cash Flow (OCF) was -$496M, and its Free Cash Flow (FCF) stood at -$617M for the year. These figures indicate a declining trend since 2018, highlighting Nikola’s ongoing cash flow challenges.

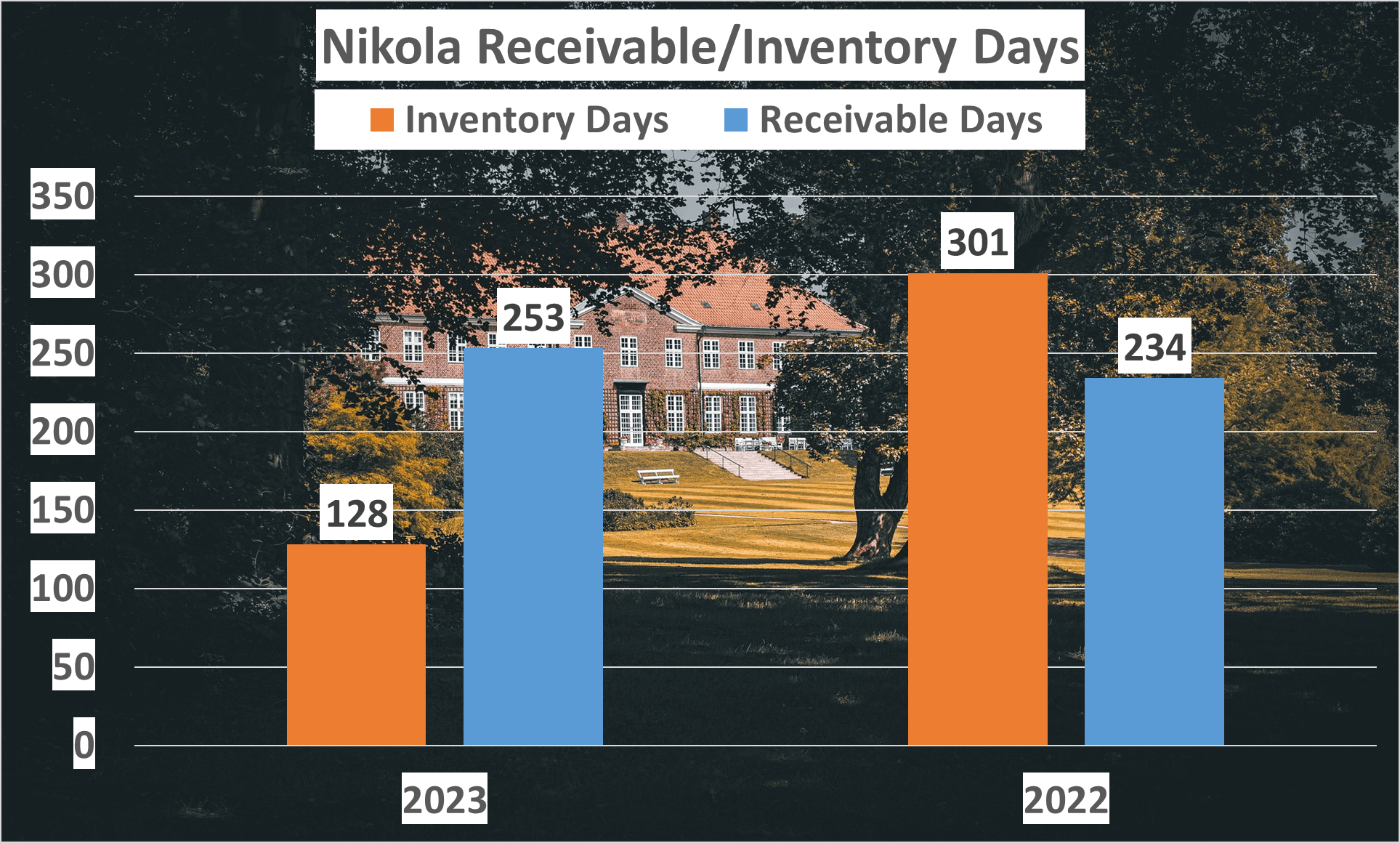

Now, let’s focus on efficiency. Two vital indicators are Inventory Days and Receivable Days. In 2023, Nikola’s Inventory Days decreased to 128 days from 301 days in 2022, signaling improved inventory turnover. However, Receivable Days increased to 253 days from 234 days, suggesting delayed collection of accounts receivable.

While the decrease in Inventory Days is positive, the rise in Receivable Days raises concerns. These figures imply inefficiencies in Nikola’s operations, leading to prolonged inventory turnover and delayed cash conversion.

In conclusion, Nikola’s cash flow and efficiency metrics in 2023 paint a worrying picture. Negative OCF and FCF, coupled with high Receivable Days, indicate challenges in cash management and operational efficiency. Investors should carefully consider these factors when assessing Nikola’s financial health.

ROE Analysis and Conclusion – Nikola Stock Analysis

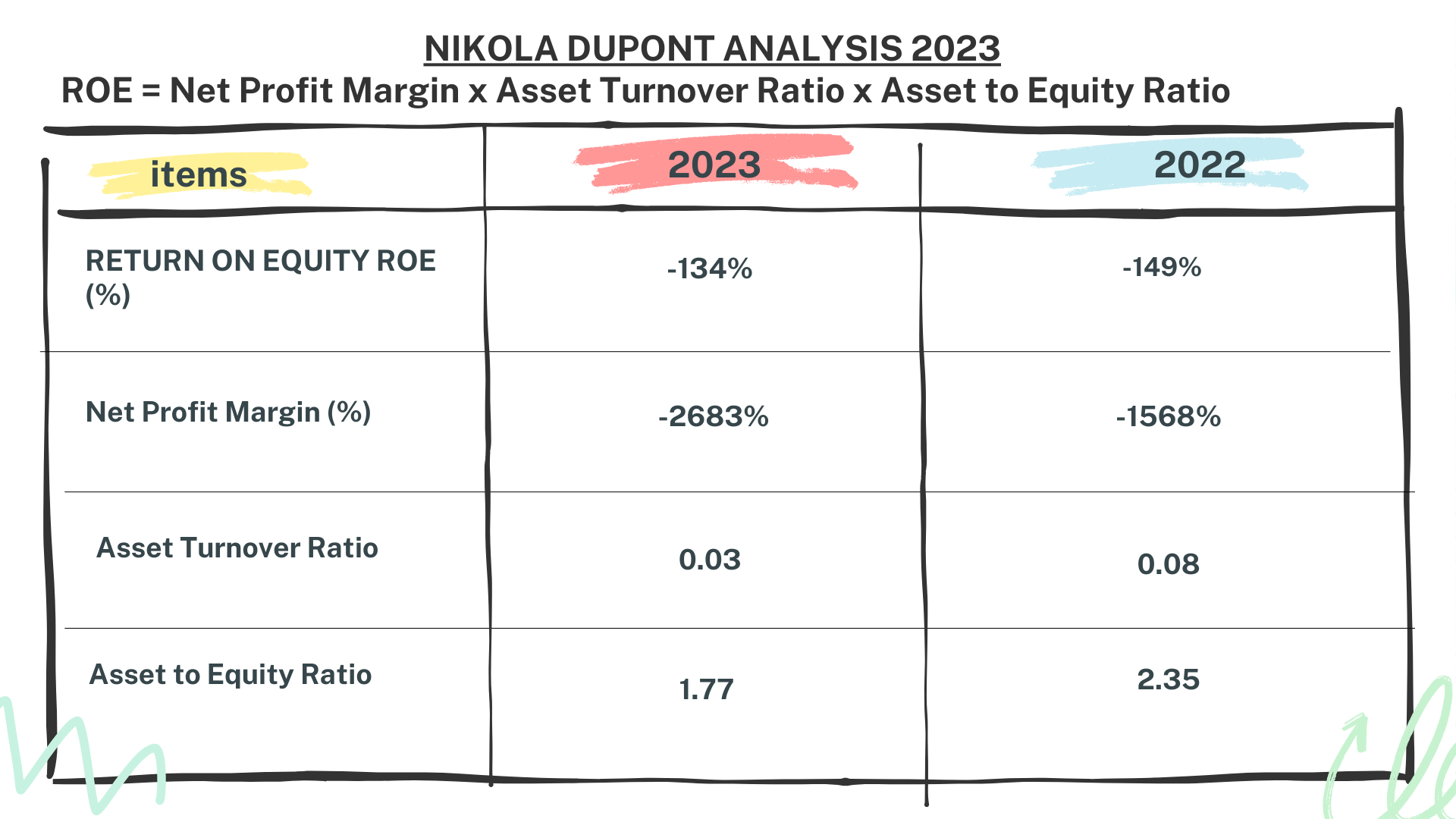

Let’s dive into Nikola’s Return on Equity (ROE) using the Dupont analysis, breaking it down into Net Profit Margin, Asset Turnover, and Asset to Equity.

In 2023, Nikola’s Net Profit Margin stood at a staggering -2683%, indicating a loss of $26.83 for every dollar of revenue. Additionally, the Asset Turnover was a mere 0.03, implying that Nikola generated only three cents of revenue for each dollar of assets. The Asset to Equity ratio was 1.77, suggesting that slightly over half of Nikola’s assets were financed by equity.

Comparing these metrics to 2022 reveals a consistent financial struggle. The ROE was -149%, with a Net Profit Margin of -1568%, Asset Turnover of 0.08, and Asset to Equity ratio of 2.35.

In conclusion, a comprehensive analysis of Nikola’s financials could have prevented significant investment losses. The negative Net Profit Margin, low Asset Turnover, and high Asset to Equity ratio are all warning signs of potential financial distress.

Always conduct thorough due diligence before investing. Understanding these financial metrics can aid in making informed investment decisions and mitigating risks. Feel free to suggest companies for our future analyses. Thank you for watching!

Author: investforcus.com

Follow us on Youtube: The Investors Community