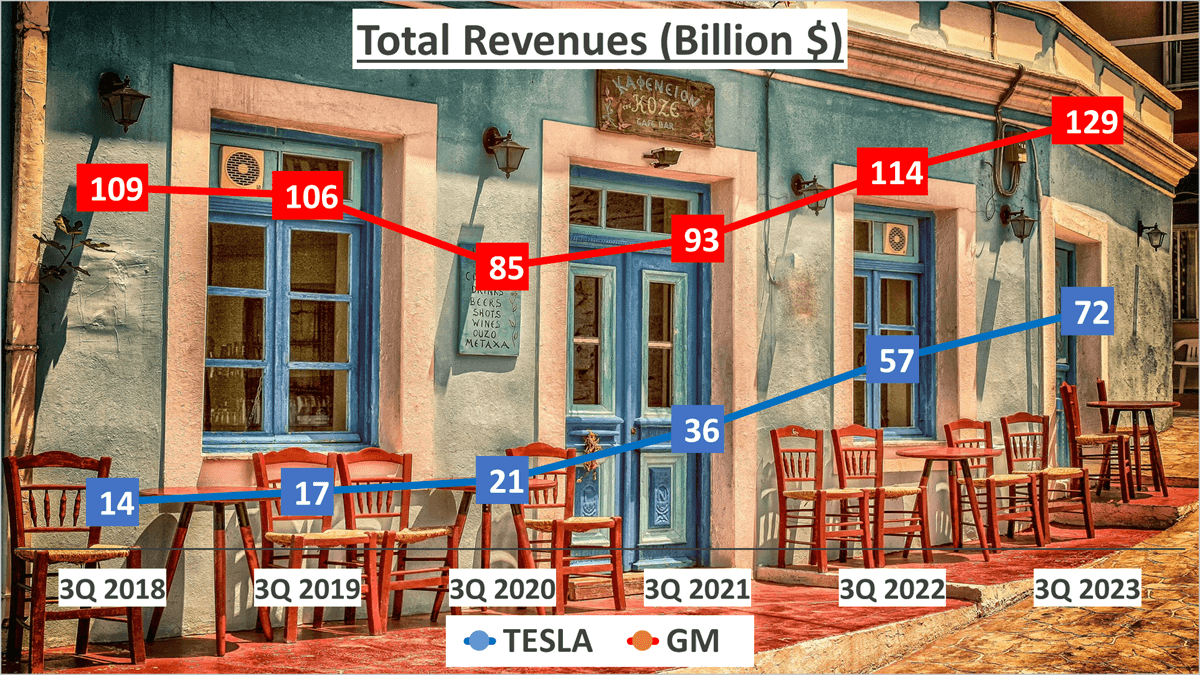

Financial Performance Overview – Tesla vs GM Stock Analysis: Ever pondered over how Tesla vs GM Stock Analysis stack up in their financial performance? Well, let’s delve into it. In the third quarter of 2023, Tesla’s total revenues reached a staggering 72 billion dollars, while GM’s total revenues clocked in at a whopping 129 billion dollars. If we look at a five-year period, Tesla’s revenues have grown at a compounded annual growth rate, or CAGR, of 38 %. On the other hand, GM’s growth rate over the same period was a modest 3%. This clearly shows that while GM’s growth is slowing, Tesla’s has been noticeably increasing.

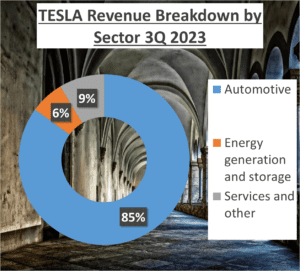

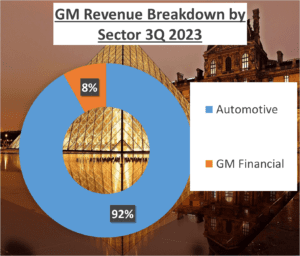

Now, let’s talk about the revenue structure of both these automotive giants. For Tesla, 85% of its revenue comes from its automotive segment, 6% from energy generation and storage, and the remaining 9% from services and other sources. GM, on the other hand, has a simpler revenue structure with 92% coming from its automotive segment and 8% from GM Financial.

In a nutshell, Tesla’s diverse revenue streams have helped it to maintain a steady growth rate, despite the volatile nature of the automotive industry. GM, on the other hand, seems to be facing saturation in its growth, with a significant majority of its revenue coming from a single segment.

To sum it all up, Tesla’s financial performance over the past five years has shown an impressive growth trajectory, with a diverse range of revenue streams supporting its expansion. GM, while boasting higher total revenues, appears to be slowing down in terms of growth. The financial performance of these two companies paints a clear picture: Tesla is on the rise, while

So, the next time you find yourself pondering over the financial performance of Tesla vs GM Stock Analysis, remember this: while GM’s growth is slowing, Tesla’s has been noticeably increasing.

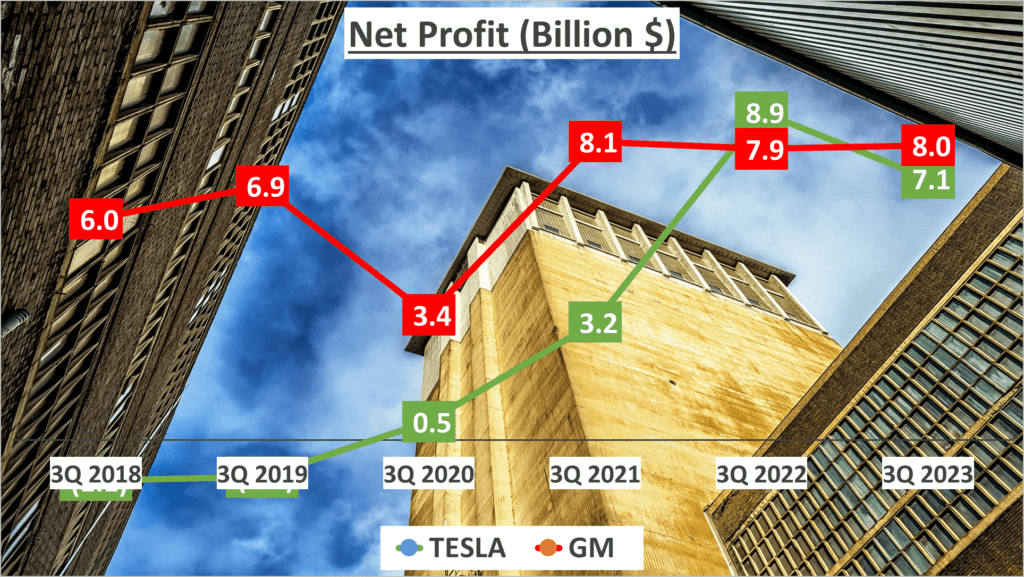

Profit Analysis- Tesla vs GM Stock Analysis

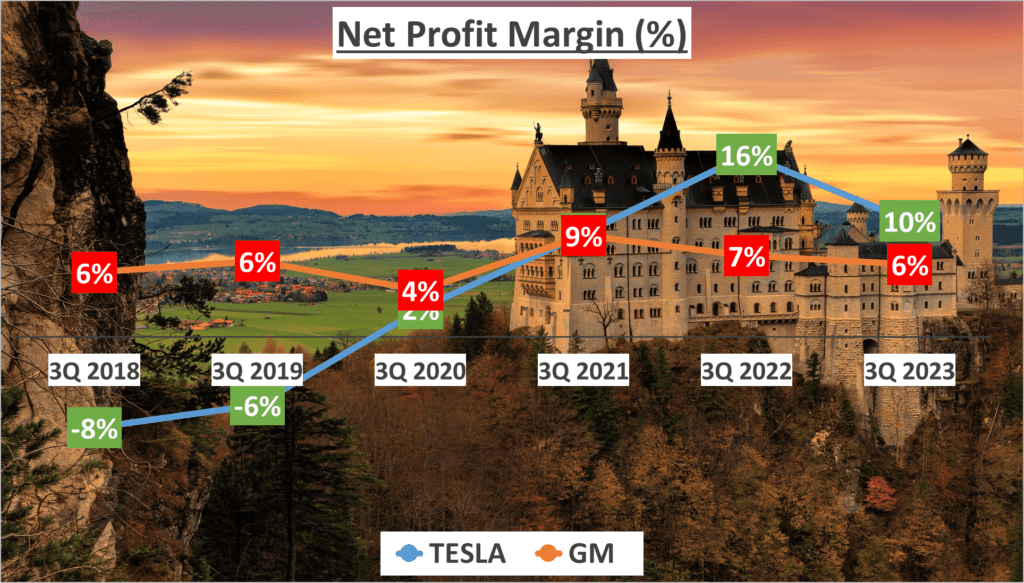

Now let’s delve into the profit margins of these automotive giants. Tesla’s net profit margin in the third quarter of 2023 was 10%, a notable increase from its five-year average of 4%. This indicates a significant improvement in Tesla’s profitability, which was in the -8% region back in 2018.

On the other hand, General Motors, or GM, maintained a steady net profit margin of 6%, identical to its five-year average. This suggests that GM’s profitability has remained consistent over the years, with little to no significant fluctuations.

As we shift our focus to the net profits of both companies in the third quarter of 2023, we observe that Tesla reported a net profit of 7.1 billion dollars. This is a remarkable growth when compared to the figures from three years ago in 2020. In fact, Tesla’s net profit has grown at a compound annual growth rate, or CAGR, of 142% over these three years. GM, on the other hand, reported a net profit of 8 billion dollars in the third quarter of 2023. While this figure is slightly higher than Tesla’s, GM’s net profit growth rate over the same three-year period is significantly lower, with a CAGR of 33 %.

What this means is that Tesla’s profitability has been improving at a much faster pace than GM’s over the past three years. While GM’s net profit has increased at a steady, albeit slower rate, Tesla’s net profit has grown exponentially during the same period.

The comparison of these two automotive giants’ profit margins and net profits provides an interesting insight into their financial performance. While GM has maintained a steady profit margin over the years, Tesla has shown a remarkable improvement.

In the third quarter of 2023, Tesla’s net profit margin improved remarkably while GM remained steady. It’s crucial to keep these trends in mind while evaluating the financial performance of these companies and making informed investment decisions.

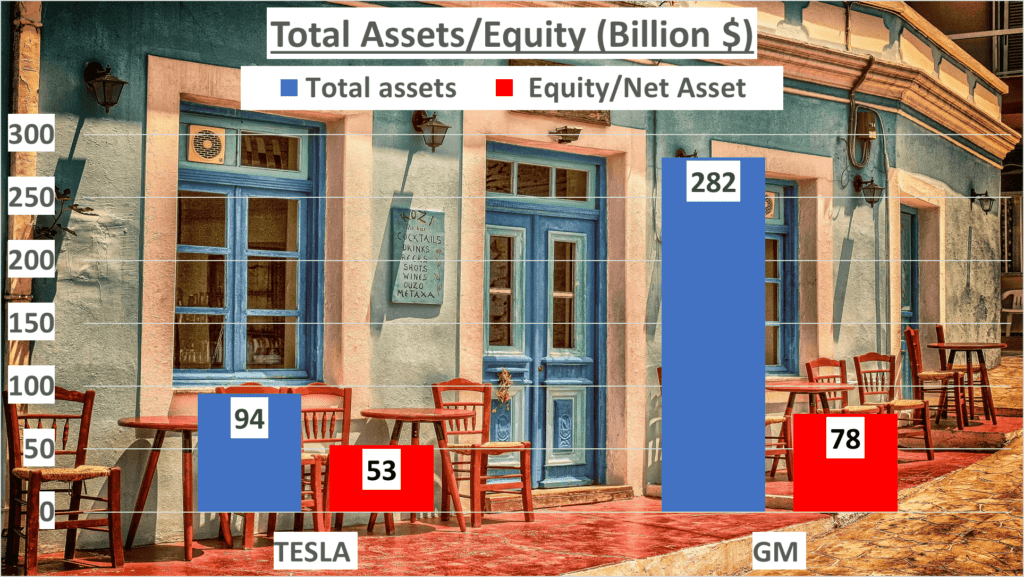

Asset Evaluation- Tesla vs GM Stock Analysis

Assets are a critical element in a company’s financial health. How do -Tesla vs GM Stock Analysis fare?

Let’s delve into the asset evaluation of these two automotive giants. As we look at the total assets at the end of the third quarter of 2023, GM stands at a towering 282 billion dollars, dwarfing Tesla’s 94 billion dollars. But remember, size isn’t everything in this game. When we consider net assets, the gap narrows significantly. GM’s net assets are 78 billion dollars while Tesla’s are 53 billion dollars. Still, GM takes the lead, but the difference is far less dramatic.

Now, let’s move onto the equity to total assets ratio, a crucial indicator of financial stability and efficiency. Here, Tesla shines with a ratio of 57%, well above GM’s 28%. This difference suggests that Tesla has a greater proportion of its total assets financed by shareholders, indicating a stronger financial structure and lower risk.

But, what does all this mean? Well, the total assets of a company give us a view of its size and the resources it has at its disposal. On the other hand, net assets and the equity to total assets ratio provide a more nuanced picture of a company’s financial health and efficiency in asset utilization.

While GM has a larger asset base, Tesla has demonstrated a more efficient use of its assets. This is evident in the higher equity to total assets ratio, indicating that Tesla is better at using what it has to generate revenue.

And this brings us to an interesting conclusion. Despite having fewer total assets, Tesla has managed to generate impressive revenues and has shown a more efficient use of its assets. This efficiency is key to Tesla’s financial health and its potential for future growth. Despite having fewer assets, Tesla’s efficient use of them to generate revenue surpasses GM.

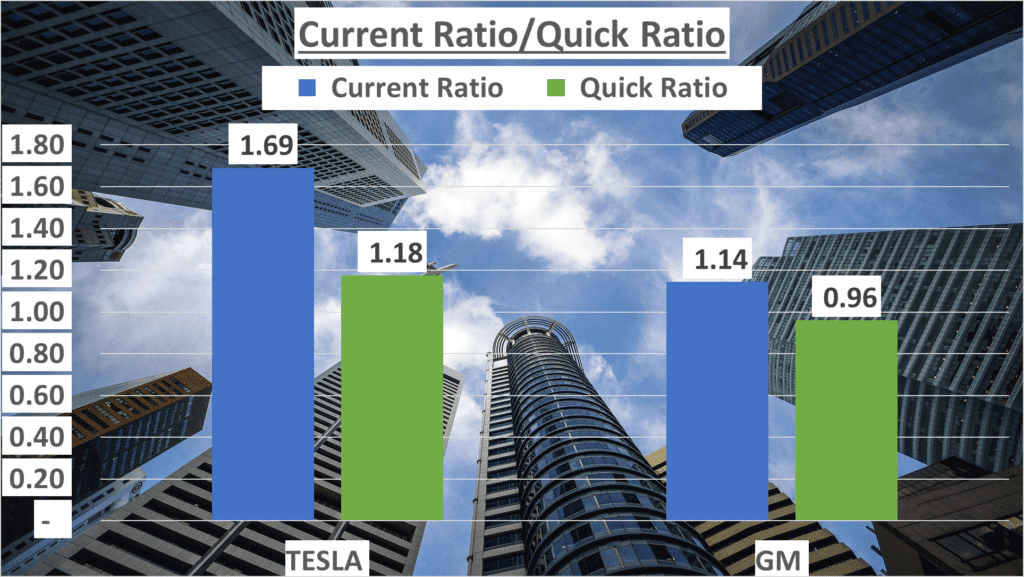

Liquidity Ratios- Tesla vs GM Stock Analysis

Liquidity ratios are crucial to assess a company’s short-term financial health. Let’s examine -Tesla vs GM Stock Analysis’s ratios.

By diving into the world of liquidity ratios, we can gain insights into how well a company can meet its short-term obligations. Two of the most commonly used liquidity ratios are the current ratio and the quick ratio.

Starting with the current ratio, this ratio measures a company’s ability to cover its short-term liabilities with its short-term assets. For Tesla, the current ratio stands at 1.69. This means Tesla 1.69 times the short-term assets needed to cover its short-term liabilities. On the other hand, GM’s current ratio stands at 1.14, showcasing that GM has just a bit more short-term assets than its short-term liabilities.

Now, let’s take a look at the quick ratio. This ratio is a more stringent version of the current ratio as it subtracts inventory from current assets before dividing by current liabilities. The reasoning behind this is that inventory may not be as quickly convertible into cash as other current assets. Tesla’s quick ratio stands at 1.18. This indicates that even without considering its inventory, Tesla can cover its short-term liabilities. In contrast, GM’s quick ratio is a bit lower, standing at 0.96, suggesting that without its inventory, GM might struggle a bit to cover its short-term liabilities.

Now, why are these ratios important? Well, they provide insight into a company’s operational efficiency and financial stability. A company with a higher current and quick ratio is generally considered to be more financially stable, as it indicates that the company can readily meet its short-term obligations, which is a good sign for investors.

In conclusion, both -Tesla vs GM Stock Analysis have their strengths and weaknesses when it comes to their liquidity ratios. However, it seems that Tesla maintains a better short-term financial health compared to GM, as indicated by its higher current and quick ratios.

Operational Efficiency and ROE Analysis- Tesla vs GM Stock Analysis

Operational efficiency and ROE are key indicators of a company’s performance. Let’s dive into these aspects.

Inventory management is crucial for auto firms. Tesla’s inventory days sit at 61, a tad higher than GM’s 40. This implies that Tesla’s products tend to sell slower compared to GM’s. However, it’s not all black and white. The accounts receivable days for Tesla are just 10, significantly lower than GM’s 29. This suggests that Tesla has optimized its sales policies to consumers, resulting in a quicker collection of payments.

Now, let’s talk cash flow. Tesla’s operating cash flow stands at 8.9 billion dollars, while GM’s is almost double, at 17.3 billion dollars. But when we look at free cash flow, we see Tesla at 2.3 billion dollars and GM at 10.3 billion dollars. It’s important to note here that Tesla’s operating cash flow to net income ratio is 1.3, compared to GM’s 2.2. This ratio indicates the ability to generate cash from business operations relative to the net profit on their income statement.

Finally, let’s break down the Return on Equity or ROE. Tesla’s ROE in the third quarter of 2023 was 18, with a net profit margin of 10 %, an asset turnover of 1.08, and an asset to equity of 1.76. On the other hand, GM’s ROE was 14%, with a net profit margin of 6%, an asset turnover of 0.63, and an asset to equity of 3.59. What does this mean? Well, Tesla has a higher net profit margin and asset turnover, while GM uses more leverage, resulting in a higher asset to equity ratio.

Tesla outshines GM in terms of operational efficiency and ROE, primarily driven by a higher Net Profit Margin and Asset Turnover.

So, that’s a wrap on Tesla’s and GM’s financial performances. Both have their strengths and areas of improvement. Investors must weigh these factors before making investment decisions. Remember, knowledge is power when it comes to investing. Until next time!

Watching more on Youtube:

Author: investforcus.com

Follow us on Youtube: The Investors Community